Credit unions are on a mission, to get to know today’s youth and bring them some much-needed financial education.

Generation Y, or the Millenials, roughly age 17-32...they are not only the largest group of consumers since the Baby Boomers but are also confident, optimistic, diverse,

technologically proficient, socially conscious, eager, powerful, team-oriented, and ambitious.

Generation Z, or the

Digital Natives, roughly age 2-16…they are smart and very

tech-savvy (even dependent on technology), socially responsible, constantly multitasking,

always connected, global, flexible, respectful, and culturally tolerant.

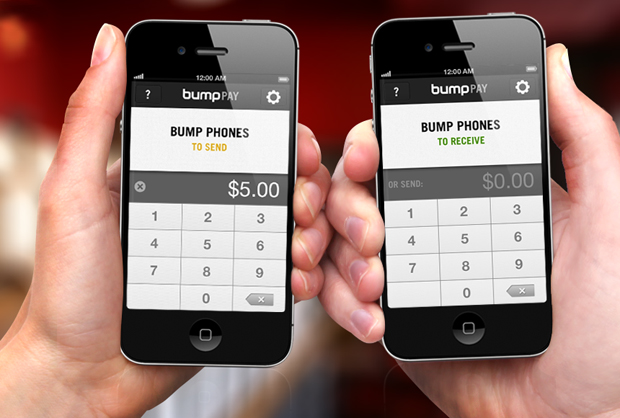

Credit unions have a chance to leverage technology to connect with these younger would-be members. Is your credit union ready for the challenge?

Read the full article here.